FinServe MarketPlace, the Anti-Backdoor! If you think having a deal back-doored stinks, you've found the right marketplace!

FinServe — The Accelerator for Portfolio Lenders and ISOs

FinServe MarketPlace is built around one core principle: sustainable acceleration through partnership.

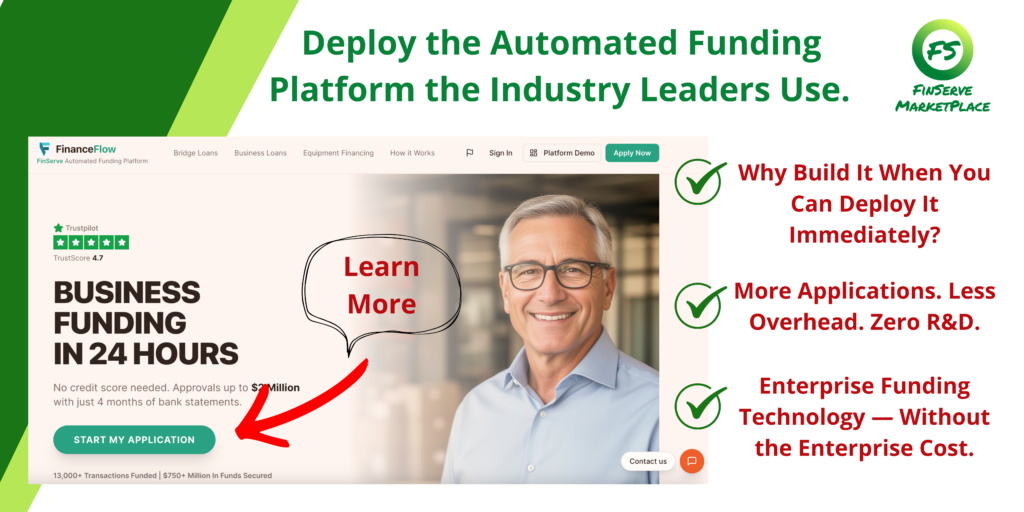

FinServe is not a marketing vendor. We are a growth infrastructure partner for lenders, funders, and ISOs who want to scale responsibly, predictably, and profitably. With more than 14 years of industry experience, FinServe has developed inbound origination systems, automated funding platforms, operational technology frameworks, and automation strategies designed to perform in both expansion cycles and tightening credit markets.

Our focus is simple: build distribution, install accountability, and create scalable operational leverage for every Portfolio Lender.

What Makes FinServe Different

Proven, Long-Term Industry Experience

With 14+ years serving the commercial finance sector, FinServe understands lender economics, ISO behavior, referral partner activation, and funding lifecycle dynamics. Our partnerships are built to withstand industry shifts, regulatory changes, and economic fluctuations.

A National Referral Partner Ecosystem

FinServe maintains the largest curated commercial finance network in the United States, including:

-

18,000+ business finance broker and ISO members

-

5,000+ CPA, banking, and professional referral partners

For Portfolio Lenders and ISOs, this means immediate access to established distribution relationships rather than building from zero.

True Strategic Partnership

We work directly with lender leadership to:

-

Align marketing with credit box and underwriting appetite

-

Design scalable onboarding frameworks

-

Implement automation infrastructure

-

Optimize operational throughput

This is collaborative growth architecture — not outsourced lead generation.

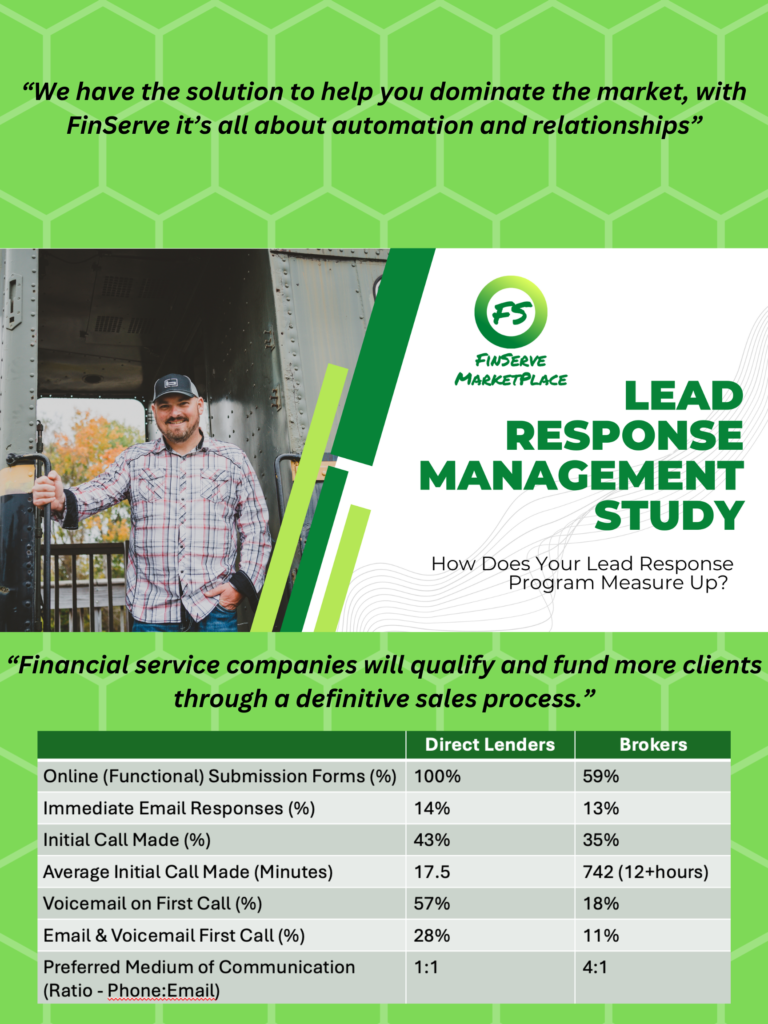

Lead Response Management & Automation Infrastructure

FinServe deploys structured Lead Response Management systems that ensure:

-

Speed-to-contact

-

Automated follow-up sequences

-

BDR accountability

-

Data-driven onboarding measurement

-

Conversion optimization

The result is disciplined, repeatable referral partner activation and consistent submission flow.

Growth Through Operational Leverage

FinServe helps lenders scale without proportionally increasing headcount. By automating communication, reporting, and onboarding workflows, we reduce administrative burden and allow your team to focus on relationship building and funding execution.

Acceleration comes from systems — not just volume.

FinServe’s Core Focus:

Maximizing Market Footprint

Our philosophy is simple: when a referral partner or ISO needs a specific funding solution, they should already know who you are.

FinServe works to position our Portfolio Lenders across our ecosystem so that when opportunity arises, you are top-of-mind and strategically placed.

Sustainable Growth Models

Our programs are built for longevity. We design systems that:

-

Perform in competitive markets

-

Remain effective during economic contraction

-

Adapt to changes in technology and communication channels

-

Maintain operational efficiency over time

Sustainable infrastructure always outperforms short-term marketing spikes.

What Partnership with FinServe Enables

Targeted Placement with 18,000+ Referral Partners & ISOs

At the exact moment a referral partner needs your funding solution, your platform is already positioned within the FinServe ecosystem. Distribution is intentional, not accidental.

Access to 1,000,000+ Borrower Profiles

For lenders and ISOs seeking direct borrower engagement, FinServe maintains a large borrower database ecosystem. Our systems ensure that when borrowers are actively seeking capital, aligned funding partners are positioned appropriately within the process.

Sales Funnel Automation at Every Stage

From inbound engagement to onboarding to ongoing relationship management, FinServe automates critical stages of the sales funnel to create:

-

Faster response times

-

Higher onboarding rates

-

Reduced manual workload

-

Greater consistency

Expand Production While Reducing Human Capital Pressure

By embedding automation and operational systems into your organization, FinServe helps you increase submission volume and funding throughput without needing linear increases in staffing.

You gain operational leverage — not just more leads.

Your Growth Partner

At its core, FinServe exists to help commercial finance organizations accomplish what would otherwise take years of internal infrastructure building.

Through:

-

National referral partner distribution

-

Automation-driven onboarding systems

-

Operational consulting

-

Data reporting and performance measurement

-

Strategic ecosystem alignment

FinServe acts as the accelerator behind scalable lending platforms.

If you are serious about expanding your footprint, strengthening your distribution network, and installing infrastructure that compounds over time, explore whether becoming a FinServe Portfolio Lender or ISO is the right strategic move for your organization.

We are not a vendor.

We are the accelerator behind your next stage of growth.

Our Technology Expertise and Lead Generation Programs Will Help You...

Lenders, Funders, ISOs we can help you automate your operations! Learn what our recommended Lenders and Tech ISOs do to win more business with FinServe.

Sustainable Marketing Programs For Business Finance Lenders and Funders

Learn More About Our Lead Gen Programs

Download Our Lead Response Management Report!