FinServe’s Business Acceleration Program is designed to streamline the process of generating, managing, and converting inbound leads from referral partners and independent sales organizations (ISOs) into successful partnerships for lenders. Here’s a breakdown of how the program works:

1. Inbound Lead Generation

FinServe creates and manages over 200 marketing campaigns to attract referral partners and ISOs and direct them to your lending platform. These campaigns are executed through a variety of channels:

- Referral Marketing Emails & SMS/Text: Targeting referral partners and ISOs with tailored messaging.

- Lender Brand Emails: Integrated into lender’s own marketing.

- Social Media: Promoting lending opportunities.

- SMS/Text: Direct communication to capture referral partner and ISO attention.

Once a referral partner or ISO engages with the campaign and fills out a form, FinServe’s Lead Response Management (LRM) system automatically notifies both the lending team and the assigned BDR in real time.

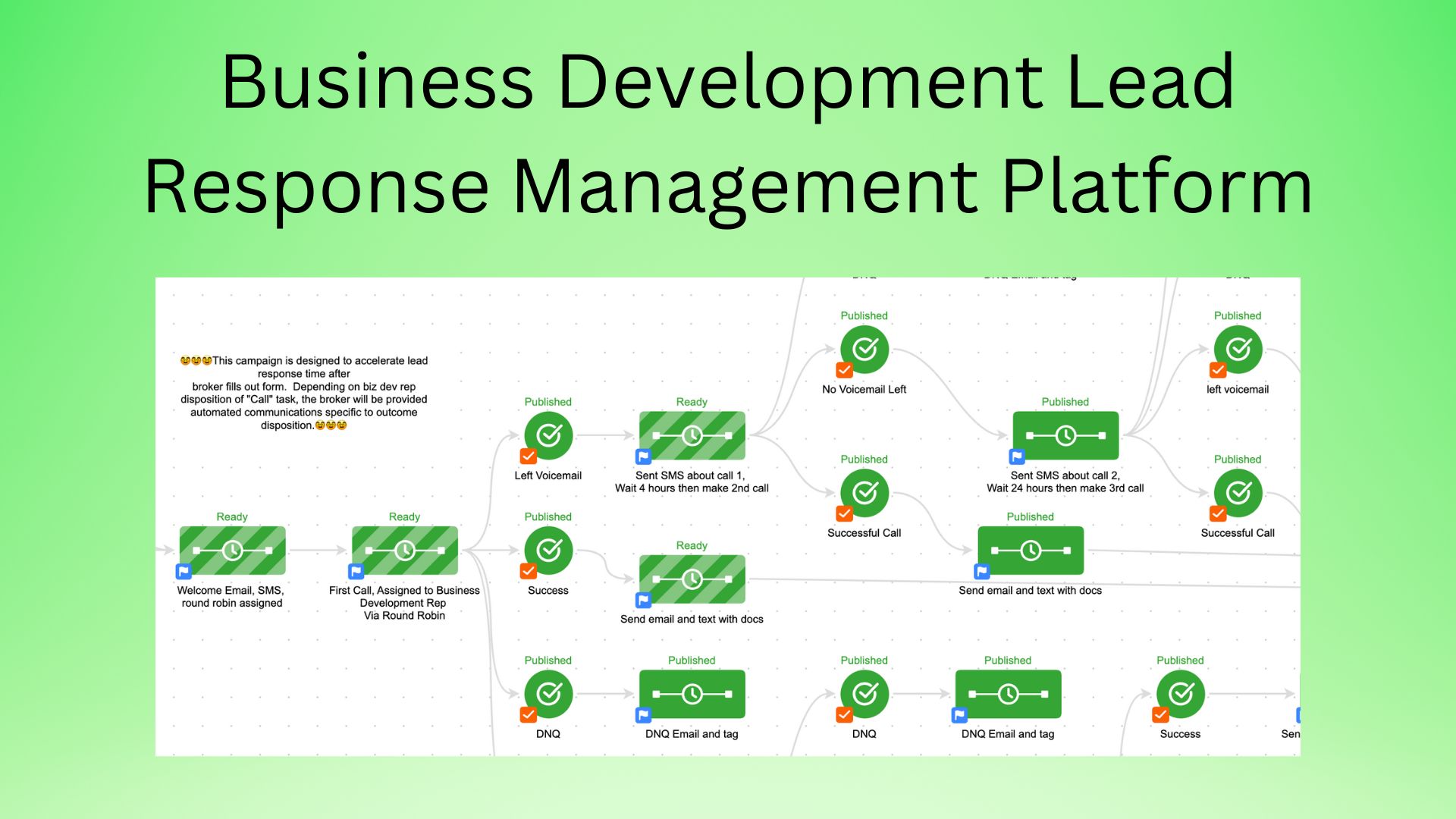

2. Lead Response Management System (LRM)

FinServe implements an automated Lead Response Management system for lenders and their BDRs. This system ensures that BDRs are held accountable for effectively onboarding referral partners and ISOs into your marketplace by streamlining communication and follow-ups. Key features:

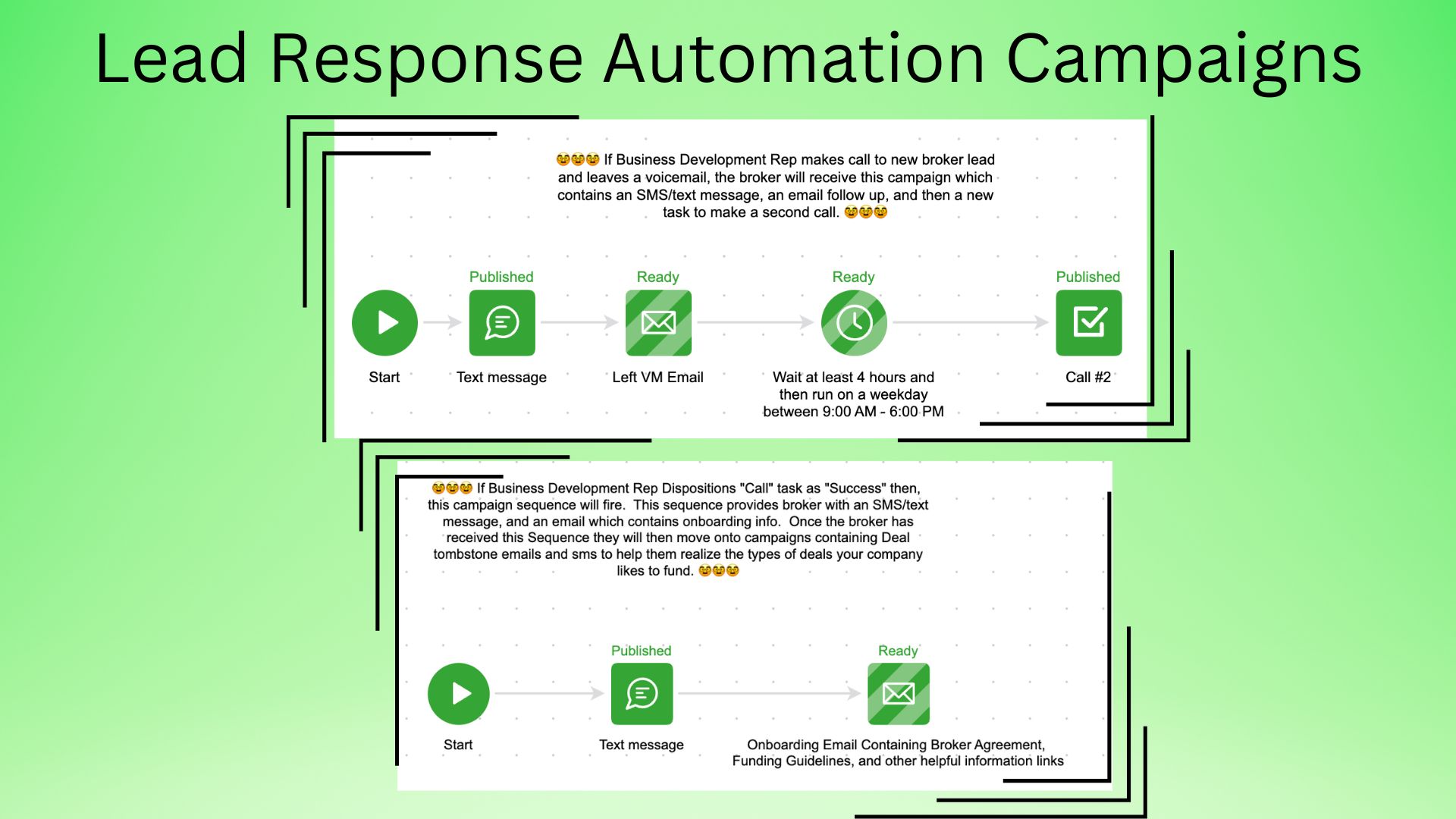

- Task Dispositioning: BDRs log call outcomes (e.g., “Success,” “Left VM,” “No Answer,” or “DNQ”) in real-time.

- Success: Sends ISO agreements, guidelines, and any other relevant materials automatically to the ISO.

- Left VM: Triggers follow-up SMS and email communication to the referral partner or ISO, as well as automated task creation for a follow-up call.

- No Answer: Automates follow-up communication to the referral partner or ISO and generates another call task for the BDR.

- DNQ (Did Not Qualify): Sends a notification to the referral partner or ISO but stops further communication with those leads who are not deemed a good fit.

This system uses data-driven insights from Harvard Business Review/MIT and FinServe’s own study to follow an optimal lead response cadence, ensuring high conversion rates and consistency.

3. Training and Implementation

After the Lead Response Management system is deployed, typically within 14 days of initiating the relationship, FinServe provides training to your business development team. The system is designed to be simple and seamless, enabling your BDRs to adopt it quickly. The primary goal is to reduce the time BDRs spend on administrative tasks by automating communication, freeing them up to focus on engaging with high-potential referral partners/ISOs.

4. Data Reporting

As referral partners and ISOs go through the onboarding process, FinServe provides detailed data reporting on the performance of each BDR and the onboarding success rate. This allows lenders to:

- Track the number of referral partners and ISOs successfully onboarded.

- Identify which BDRs are performing well and which may need additional support or training.

With this data, you can optimize your team’s approach and increase the overall efficiency of the onboarding process.

5. Experience

FinServe has deep expertise in inbound lead generation, marketing technology, and sales enablement, with a proven track record. Key highlights of our experience:

- Industry Expertise: Founded by Steve Conner, who has been implementing business acceleration systems, and technologies since 2004, with a focus on Salesforce, Inside Sales, and Keap/Infusionsoft.

- Proven Success: FinServe has facilitated programs that have helped some groups grow by as much as 10x.

The combination of advanced operational technology and vast industry experience makes FinServe a strong partner for lenders looking to scale their businesses.

Conclusion

If your lending firm is ready to accelerate growth and onboard more referral partners and ISOs, FinServe’s Business Acceleration Program provides a comprehensive, automated system that streamlines lead generation, lead response management and technologies, training, and reporting. With FinServe’s expertise and track record, lenders can efficiently increase their pipeline, improve conversion rates, and enhance overall productivity.

If you’re ready to scale, FinServe Marketplace could be the ideal fit to help you achieve your goals.